digital payment solution

eCommerce

Enables channels for online sales and collections from any device, through any channel, and with any payment method.

Our digital payment solution eCommerce is more than just a payment button. It is the most complete solution for digital transactions.

You can receive online payments made from any device with ATH cards or any other payment method

We can integrate with any ERP or information system

We improve the user experience in digital payment processes

Accepts QR Code payments

Our ISO/IEC 29110 Certification guarantees you quality software.

Solution features

- Payments: we bring quick and secure payment solutions for every type of industry, through multiple channels, even without a website.. Payment solutions include extra features you can access at no additional cost.

- Security: we reduce the risk of fraud through virtual services that adapt to your business needs.

- Data analytics: we help you understand the dynamics of your business through data analysis in order to facilitate strategic decision making in a fast and informed way.

- Payment products

- Security

We bring quick and secure payment solutions for every type of industry, through multiple channels, even without a website. Payment products include extra features you can access at no additional cost.

Microsites

Sell and collect online, even without a website. You may customize the microsite with your brand and decide whether to have your customers fill out the payment information or to set up default values.

Ideal for businesses that want fast implementation but do not have a website or a payment solution on their website.

Payment link

Make it easy for your customers to pay via WhatsApp, email, or social networks.

Ideal for businesses that do not have a webpage or are still growing.

QR code

Add contactless payment, offering your customers the possibility of paying through a QR code. Make merchant payments faster and easier with a safe and proven system that provides transparency and reliability to your customers.

Web checkout

Integrates your website in a simple way to receive online payments, recover abandoned shopping carts with our IVR, make it easy for your customers to make one-click payments through social networks with our payment link, and enable a QR code for your users to pay in contactless payment stations.

API-Conetion

Direct integration with Placetopay APIs:

• Integrate your webpage/app with Placetopay (No Redirection).

• Control the payment experience and data management.

• The business must comply with the PCI requirement and will be subject to certification annually.

Additional features

Get access to additional features at no extra cost, which you can use to optimize the services offered by our digital payment solution.

Tokenization

Gives your customers the ability to encrypt and store their credit cards for faster payment.

Ideal for businesses that want to store tokens and improve recurring user purchase processes, since they will not need to enter their card data every time they shop.

Recurrent payments

Schedule recurring payments: automatic debit for monthly installments or subscriptions.

On Placetopay, we take care of scheduling payments as requested by you (monthly, biweekly, or daily), until the date you establish.

Ideal for businesses that sell products or services on a subscription, membership, or installment basis.

Mixed payments

Your users will be able to pay their full account balance using two or more payment methods made available for the same session.

Ideal for businesses with large sales and who want to make it easy for their customers to use more than one payment method.

Virtual wallet

Your users can save their data in the Placetopay virtual wallet to streamline their purchase process and improve their experience.

Pre-authorization

Action performed before the transaction to confirm the purchase or the person, without debiting the money, the value can be completed or canceled at a later date.

Refunds

Refunds for transactions that can be offered partially or in full.

Dashboards

A dashboard or administrative console that allows you to view transactions such as chargebacks and refunds, among other things. In addition to viewing the data.

Reports

Transactional data information that helps you understand the customer, the business, and analyze trends and behaviors.

Sell and collect at ease. Placetopay includes advanced security systems so that your transactions are always protected.

3D Secure protocol

The 3DS international authentication protocol allows for data exchange between the business, the card issuer, and in some cases, the user, in order to verify that the transaction is being conducted by the cardholder.

Under this operating model, if a transaction is authenticated, it cannot generate chargebacks, thus eliminating the merchant’s liability in case of fraud.

We are certified by EMVCo in 3DS 2.0 protocols.

Scudo

We reduce the possibility of chargebacks through a modular fraud control system, keeping an adequate balance between approval rates and operating costs.

Customizable modules in accordance with the reality of your business, with the possibility of activating only those that you need:

Historical analysis, validation with financial partners, validation in risk engines, behavioral network, security filters, and/or manual review.

Information security

We are Payment Card Industry Data Security Standard (PCI-DSS) certified.

Accept payments and process sales anytime and anywhere.

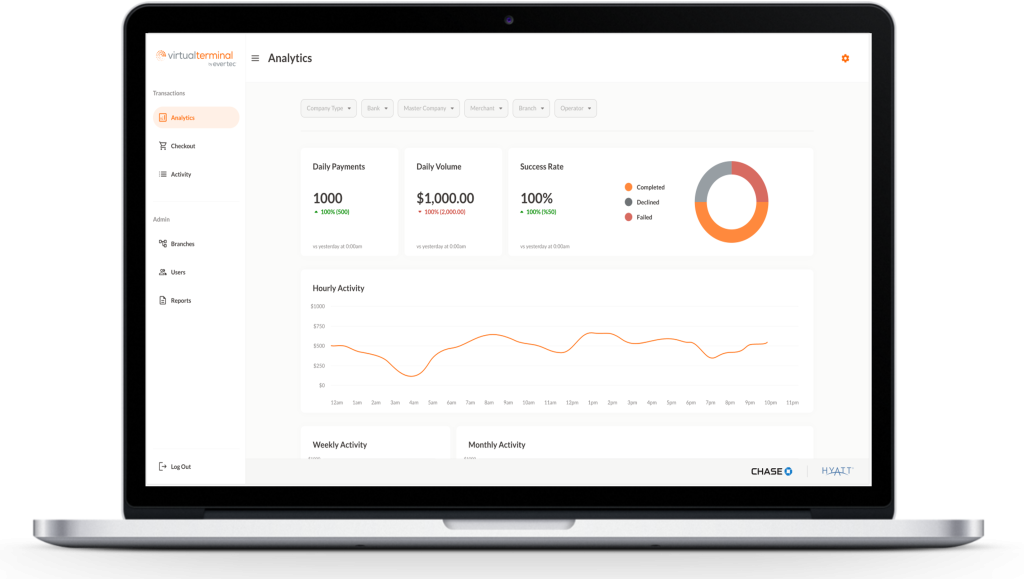

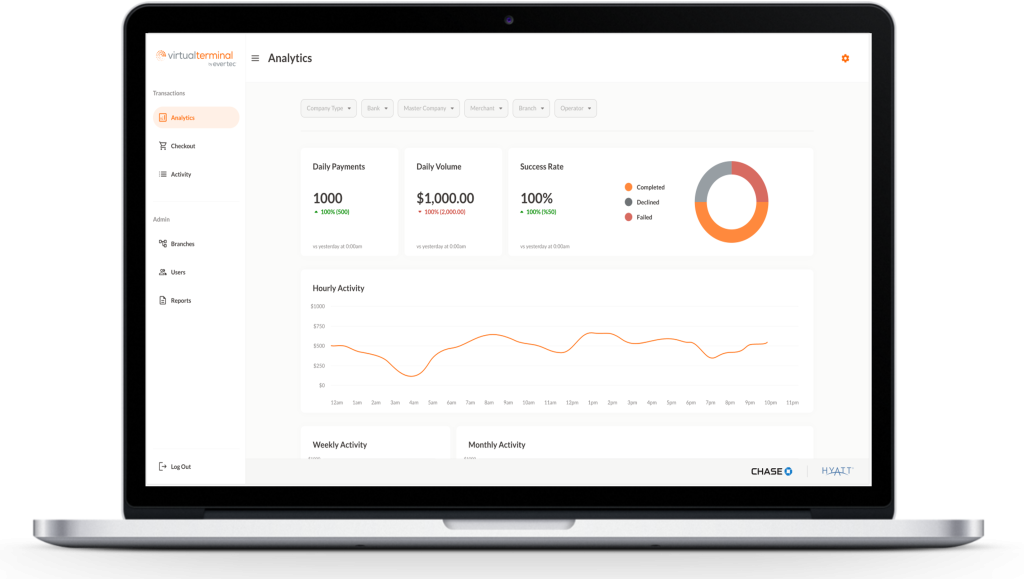

Analytics with your most important metrics.

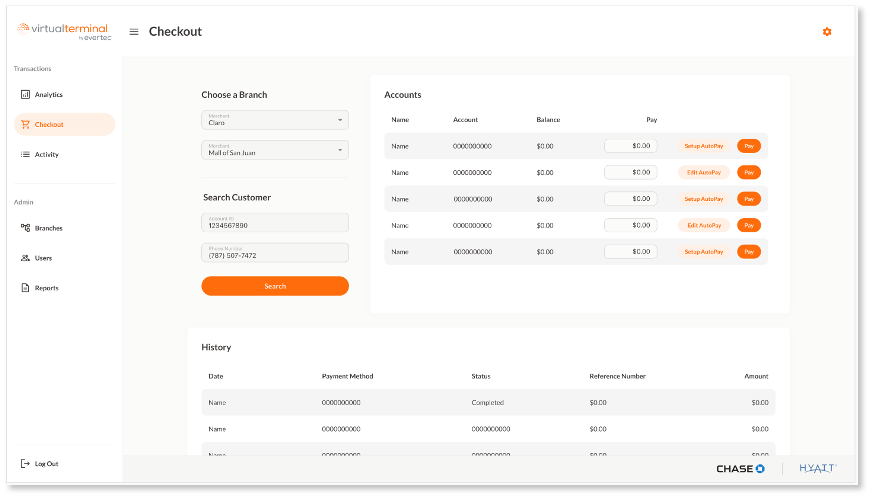

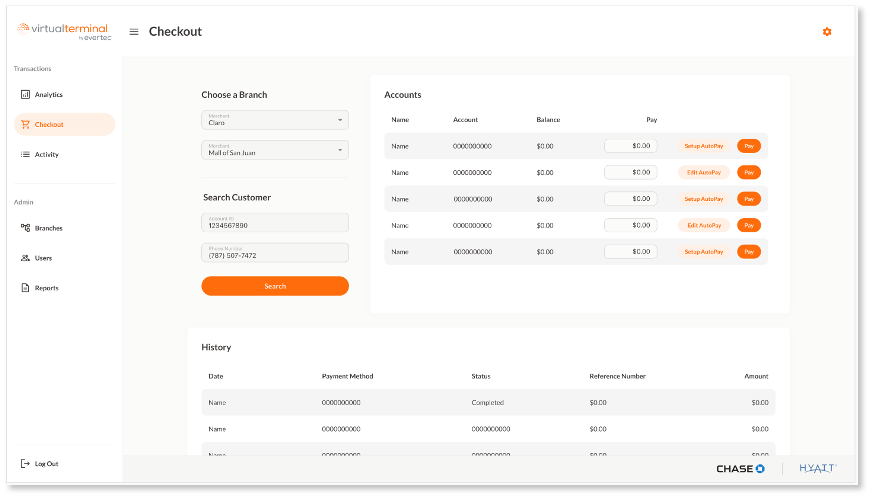

Accept debit, credit card & ACH.

Transaction payment history.

Online reports.

Daily settlement process.

What is Virtual terminal?

Virtual Terminal is a web-based solution that allows you to seamlessly manage your billing collection by accepting debit, credit, and ACH payments. Unlock the power to process electronic payments without the need for a physical point of sale (POS) terminal.

Solution features

- Secured by Multifactor Authentication (MFA).

- Online balance search.

- Online Response for real time payment posting.

- Instant payment authorization.

- User management.

Added Value Services

- Chargeback operations and management through Merchant360.

- Online Response and/or eBalance service

eBalance: Service that allows the merchant to send the data of the due balance so that it can be shown by the application.