But are local merchants ready to simplify the payment experience for cardholders with real-time information on the exact amount they need to pay in their local currency? This is no longer a challenge for acquiring banks and merchants thanks to Dynamic Currency Conversion (DCC), a strategic tool that will not only facilitate international transactions, but also boost revenues and improve the customer experience.

What is

Dynamic Currency Conversion?

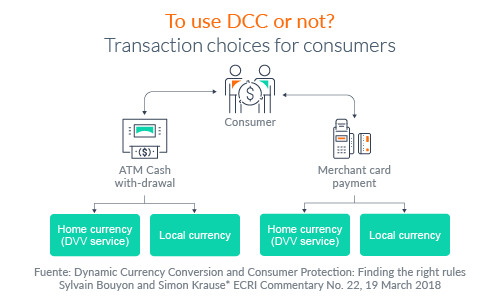

Dynamic Currency Conversion is a service that allows credit or debit card holders to pay in their home currency or reference currency when making transactions abroad. At the moment of purchase, the customer has the option to choose between paying in the merchant’s local currency or in their home currency at the exchange rate applied at the point of sale.

DCC transactions are often attractive because the currency conversion takes place in real time at the point of sale, whereas regular credit card currency conversions do not reveal the cost until the cardholder goes online or receives their statement via email.

Benefits of DCC

for merchants

- Increased revenue: by offering DCC, merchants could generate additional revenue through a currency conversion fee. This translates into a new revenue stream without the need to increase prices.

- Improved cardholder experience: tourists, in this case cardholders, often prefer to pay in their local currency to have clarity on the exact amount of the transaction. This reduces uncertainty and improves the perception of the service. The amount that will appear on the cardholder’s statement will be exactly the same as the amount that appears on the receipt given by the merchant at the time of purchase.

- Competitive differentiation: By implementing DCC, merchants can differentiate themselves from the competition by offering an additional service that is highly valued by international customers.

Advantages for

acquiring banks

- Expanded service portfolio: Acquiring banks can expand their service offering by including DCC, allowing them to attract and retain merchants that receive a high volume of international customers.

- Commission generation: similar to merchants, acquiring banks can also benefit financially through currency conversion fees, thus increasing their revenues without additional major investments.

- Strengthening the relationship with merchants: by providing a solution that helps merchants improve their profitability and customer satisfaction, banks take on a more strategic and consultative role, strengthening their relationship with business customers.

Technical and regulatory

considerations

To implement DCC effectively, merchants and acquiring banks must consider several technical and regulatory aspects:

- Technology integration: it is essential that payment terminals are configured so that the application enables DCC acceptance. This requires upgrades to the terminal software and collaboration with payment service providers.

- Regulatory compliance: DCC must be implemented in compliance with local and international regulations, including card brand regulations and consumer protection guidelines. Transparency in the applied exchange rate and fees is critical.

- Training: Both merchant staff and acquiring bank teams must be well trained to offer DCC correctly, explaining its benefits and operation to customers in a clear and accurate manner.

Dynamic Currency Conversion represents a significant opportunity for merchants and acquiring banks throughout Latin America. It not only improves the international customer experience, but also creates new revenue opportunities and strengthens competitiveness in an increasingly globalized marketplace.

Adopting DCC is a strategic step to position acquiring banks and merchants as leaders in innovation and customer service.

Fuentes:

https://es.statista.com/grafico/27241/ingresos-por-reservas-de-viajes-y-turismo-en-paises-latinoamericanos/

MasterCard

https://www.kinstellar.com/news-and-insights/detail/1882/the-problem-with-dynamic-currency-conversion-dcc

https://www.investopedia.com/dynamic-currency-conversion-dcc-term-4769305